If you’ve determined from Part 1 that a line of credit is right for you and your business, all that’s left is to apply. Here is a step-by-step guide from Stuart Blake of BlueVine.

1. Find out if your business is qualified

Ultimately, the most accurate way to find out if you qualify for a business credit line is to apply — but you wouldn’t want to apply to many lenders only to get rejected or receive a disappointing offer.

To get a quick pulse on if you’re qualified for funding, consider the factors below:

Credit score

Most lenders will look at your personal and/or business credit score to figure out the riskiness of your business. The stronger your score (680 is usually the cut-off for banks), the more options you have. However, just because you have a weaker credit score doesn’t mean you won’t be able to qualify for a business line of credit at other lenders.

Monthly/annual revenue

To determine whether you can pay back your credit line, lenders will look at your monthly or annual revenue from your income statements as well as the trajectory of your revenue over a period of time. Your annual revenue is one of the most important metrics lenders look at; when they see your sales grow month after month, it shows that you know how to run your business and execute on your business plan. This not only makes lenders more likely to lend to you, but also makes them more likely to gradually increase your credit line to support the growth of your business.

Business history

When you apply for a business line of credit, lenders will ask you how long your business has been in operation. Banks look for businesses that have been around for at least two years. If you’re a new business (between three to 12 months old), online lenders are a better option because they’re more willing to take on the risk of lending to younger businesses.

Different types of credit lines

There are many types of business credit lines. One major difference is credit lines with short or long repayment terms.

- Short repayment terms are credit lines with six to 12 months repayment terms. These terms are ideal if you’re looking to pay off your line of credit faster and want to potentially save more in interest.

- Long repayment terms are credit lines with repayment terms over 12 months. Longer repayment terms make sense if you need more time to pay off your credit line or want lower monthly payments.

Short-term business line of credit

If you’re looking for a business line of credit with short repayment terms, it’s worth applying to online lenders. Online lenders are generally a better option for businesses that are looking to save time on the application process and want access to funds on-demand. Additionally, since online lenders offer shorter repayment terms, the requirements aren’t as rigid.

When you apply to an online lender you will usually get a decision within one to two business days. To apply to an online lender follow these steps:

- Apply online: for lenders that have shorter repayment terms, they typically have an online application process that takes at most five minutes to complete.

- Upload your statements: online lenders don’t require much documentation; at most, you’ll need to upload three months worth of bank statements. If they need more information, they may ask for your tax returns and/or a debt schedule.

- Get a decision: once you’ve submitted an application, you should get a decision within one to two business days.

Long-term business line of credit

If you want to get a business line of credit with longer repayment terms, you should apply to a traditional bank. Here are the steps you’ll need to take:

- Check your credit score and business financials: to qualify for a bank line of credit you should expect to have a strong credit score of at least 680 and stellar business financials (stable cash flow, high revenue, and little to no existing debt). You may want to consult with a finance professional beforehand so that you have a clear picture of your business’s financial health.

- Get all of your documents together: When applying for a business line of credit with longer repayment terms, you must be prepared to submit a lot of documentation. This includes historical financial statements, balance sheets, tax returns, P&L statements, and income statements.

- Apply and wait: Once you’ve sorted out your documents, all you have to do is apply and wait. Some banks such as Wells Fargo still require you to visit a branch in order to submit your application. After you apply, expect to wait at least a couple of months to get a decision.

2. Compare your business line of credit options

Now that you have a general idea of how to apply for a business line of credit, your next step is to understand the major pros and cons of each type of popular lender:

Traditional bank lines of credit

Getting a line of credit from traditional banks are highly sought after because of their affordability and terms. If you manage to get a line of credit from a bank, you probably should accept the offer. But securing a line of credit from a bank is a lot easier said than done. To qualify for a line of credit, traditional banks often require at least two years of business history and $250,000 in annual revenue.

A good first step to securing a business line of credit with a bank is to contact the bank you have an existing relationship with. However, you should note that most banks have a time-consuming application process. If you have a hard time getting accepted by traditional lenders but still want reasonable rates and terms (like Bank of America or Chase) you might want to consider a line of credit from your local credit union or community bank.

Online lender business lines of credit

For those who don’t have the time or resources to spend filling out a traditional bank application, online lenders are a better option. In order to qualify for a business line of credit, most online lenders will ask you to complete the entire application online. The best part is that most online lenders don’t require sky-high credit scores or extensive financial records.

Once you submit your application, these lenders use a combination of both automation and manual underwriting to get you an offer. This means you can get a decision on your application within one to two business days. The interest rates are slightly higher with online lenders because they get the funds they lend to businesses from capital markets which is more expensive. But their application and approval processes are typically much faster.

Business credit lines from credit unions

Credit unions are member-owned and not-for-profit. This means that each member of a credit union has equal ownership and that any earnings made will go back to improving their products and services, which means lower rates and generally better products for their customers. To join a credit union, you usually must qualify for their field of membership, pay a small fee, and use your account frequently. Fields of membership vary depending on the credit union. Some credit unions are community-based, which only requires you to live within a certain area, and others are occupation-based.

A major drawback of credit unions is ease of use. Most credit unions have fewer branches and ATMs, which can make drawing funds a hassle. Additionally, credit unions don’t have strong mobile and online banking capabilities like online lenders and banks.

3. Know the minimum requirements

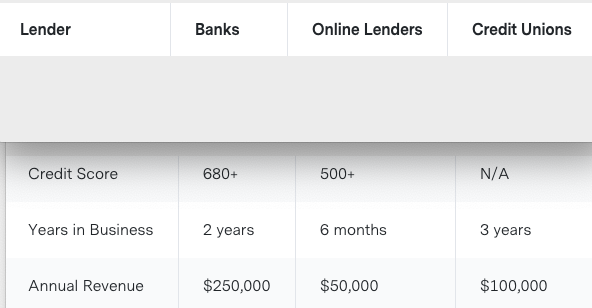

The following table is a broad overview of the minimum qualifications for each lender. As you can see, traditional banks are the hardest to qualify for, followed by credit unions and online lenders. Please note that the information here is not definitive; you should use it as a benchmark to gauge where your business stands the best chance of getting a business line of credit.

4. Understand the total cost of interest rates and fees

Annual percentage rate (APR)

When it comes to rates, it’s often thought that APR is the only rate to keep an eye out for, but that simply isn’t true. APR, or annual percentage rate, is an annualized percentage of the original loan amount plus the additional fees.

While knowing the APR is important, in some cases knowing the simple interest rate – the amount of interest you pay as a portion of the loan – makes more sense and may be cheaper. For instance, if you plan on borrowing money for less than a year, calculating the simple interest rate would give you a clearer picture of how much the loan would cost you than an annualized rate.

Simple interest rate

The simple interest rate is the interest you’ll pay to the lender on top of the loan you’re borrowing. You can use this formula to calculate simple interest rate:

Simple interest rate = Total interest charged / Loan amount

So if you are charged $100 in interest fees on a $10,000 six-month loan, you would pay a 1% simple interest rate.

Other lender fees

Here are some of the most common fees that lenders charge to use a business line of credit.

- Draw fees: Draw fees cost between one to two percent of the total draw amount. They are charged on each draw that you take.

- Payment processing fees: Payment processing fees are incurred depending on how fast you want funds deposited in your bank account. A wire transfer can get you funds within hours but usually costs between $15 to $35. The ACH method is usually free of charge but takes about two or more business days to complete.

- Late fees: When you pay late or fail a payment, you may be charged with late fees. Late fees usually cost a low percentage of your credit line but can add up quickly.

- Termination fees: If you decide to end your line of credit at any point before the full term of your loan, you may have to pay a termination fee of one to two percent of your credit line.

- Prepayment fees: Some lenders will actually charge fees if you pay your draws off early. These fees range from 3 to 5 percent of the loan principal. The good news is that many online lenders offer no prepayment fees.

5. Gather your financial documents and apply

The last step to get a business line of credit is to gather your documents and wait for the right time to apply. Here are some of the documents and type of information you’ll be expected to submit to a lender:

- Personal information: to verify your identity, lenders will require you to submit information about yourself. This includes your full legal name, social security, criminal record, and educational background.

- Bank statements: many lenders require at least one year of bank statements; alternative lenders are the exception to this and need only three months of statements.

- Financial statements: to determine the financial strength of your business, you’ll need to submit important financial statements such as your P&L sheet, cash flow sheet, and balance sheet.

- Information about other stakeholders: if you own less than 50% of the business, you must provide information about any additional stakeholders.

- Legal documents: depending on the lender you apply to, you will be expected to submit one or more of the following: business licenses and registrations, business formation document, business tax ID, contracts with third parties and/or UCC filings.

- Debt schedule: if you have any existing debt, some lenders will expect you to provide a debt schedule. This shows all your business’s outstanding loans, credit, and payment schedule.

- Tax returns: lenders will require you to show personal and business income tax returns over the last three years.

After you’ve applied, all you need to do is wait. Applying when your business is doing well is a smart way to increase your chances of getting a business line of credit, as well as getting a higher credit line amount.

This post originally appeared on the BlueVine blog at https://www.bluevine.com/how-to-get-a-business-line-of-credit/.